The housing market continues chugging along. The only thing that could derail it is the nationwide shortage of houses. As the National Association of REALTORS® (NAR) recently reported, there are 410,000 fewer homes listed than there were just a year ago.* In order to keep up the momentum in residential real estate, more listings must become available.

Understandably, a number of homeowners have concerns about what hurdles they might face if they decide to sell a house.

Is it smart to sell a house right now? 4 major incentives

Homes.com published a new survey highlighting these worries, plus the conditions needed to help sellers feel more comfortable.

Here are the top four concerns among homeowners with a short recap of what’s really going on in today’s market:

1. Homeowners aren’t sure they can find a new home if they sell.

Leverage is the ability one party has to influence another during the negotiating process. This leverage comes from the power to offer benefits or reduce costs for the other party involved.

Homebuyers in today’s market have strong reasons to buy a house, such as:

- Owning a home that’s their own.

- Purchasing before housing prices rise again.

- Locking in a historically low mortgage rate, while they can.

The demands of these buyers give sellers enormous leverage. Most homeowners already know that having this leverage allows them to sell a home at a great price. On top of that, this leverage could also help negotiate extra time to find another house.

To provide an example, if you sell your home right now, you’re giving a buyer the chance to secure today’s record-low mortgage rates. Because of this, they might be willing to return the favor and lease your home back to you for a set amount of time, until you put in an offer on a new home or build one.

In this scenario, you’re giving the homebuyer what they’re asking for, and they’re giving you the same in return. Everyone wins.

2. Homeowners aren’t sure if they’ll sell at or above asking price.

It’s a prime time to sell a house at a profit. A recent NAR study shows that bidding wars have hit a new high. The study compares last year’s first quarter to this year’s first quarter — noting that the average home received two times as many offers, rising from 2.4 to 4.8.

Bidding wars naturally cause an item’s price to increase. Bloomberg confirms that:

“For the first time ever, the average U.S. home is selling for above its list price.”

Are you hoping to sell for top dollar? Now is the optimal time to do it.

3. Homeowners aren’t sure if they’ll need to renovate to receive a competitive offer.

Remember, you have significant leverage on your side if you’re planning to sell a house today. Since inventory is so tight, many more homebuyers are opting to take on renovation projects themselves so they can nab the home they have their eye on.

As noted in a recent blog post, future owners of your home may prefer to remodel the kitchen or bathroom themselves, choosing the design that better suits their taste. If you’re selling, your time and money are likely to be better put toward minor cosmetic upgrades and necessary fixes, like touching up paint and power washing your home’s exterior.

No need to overinvest in upgrades that a buyer may decide to improve again anyway. Just ask your real estate agent which projects are worth your resources to boost your listing, without overspending.

A seller who’s worried about needing to update their home must remember that historically low levels* of housing inventory are making today’s homebuyers more forgiving.

“They delivered incredible service and made a potentially stressful process… stress-free! Even sent the closing papers to our house so we could sign and complete them at home.” – Click here to find a Cornerstone loan officer near you.

4. Homeowners aren’t sure how long it’ll take to close.

While speed certainly matters, there are two points to consider:

- How long it takes to get a buyer interested in your house.

- How long it takes to close on this transaction.

As NAR explains in their Existing Home Sales Report:

“Properties typically remained on the market for 18 days in March, down from 20 days in February and from 29 days in March 2020. Eighty-three percent of the homes sold in March 2021 were on the market for less than a month.”

Eighteen days is incredibly fast, making a brand-new record.

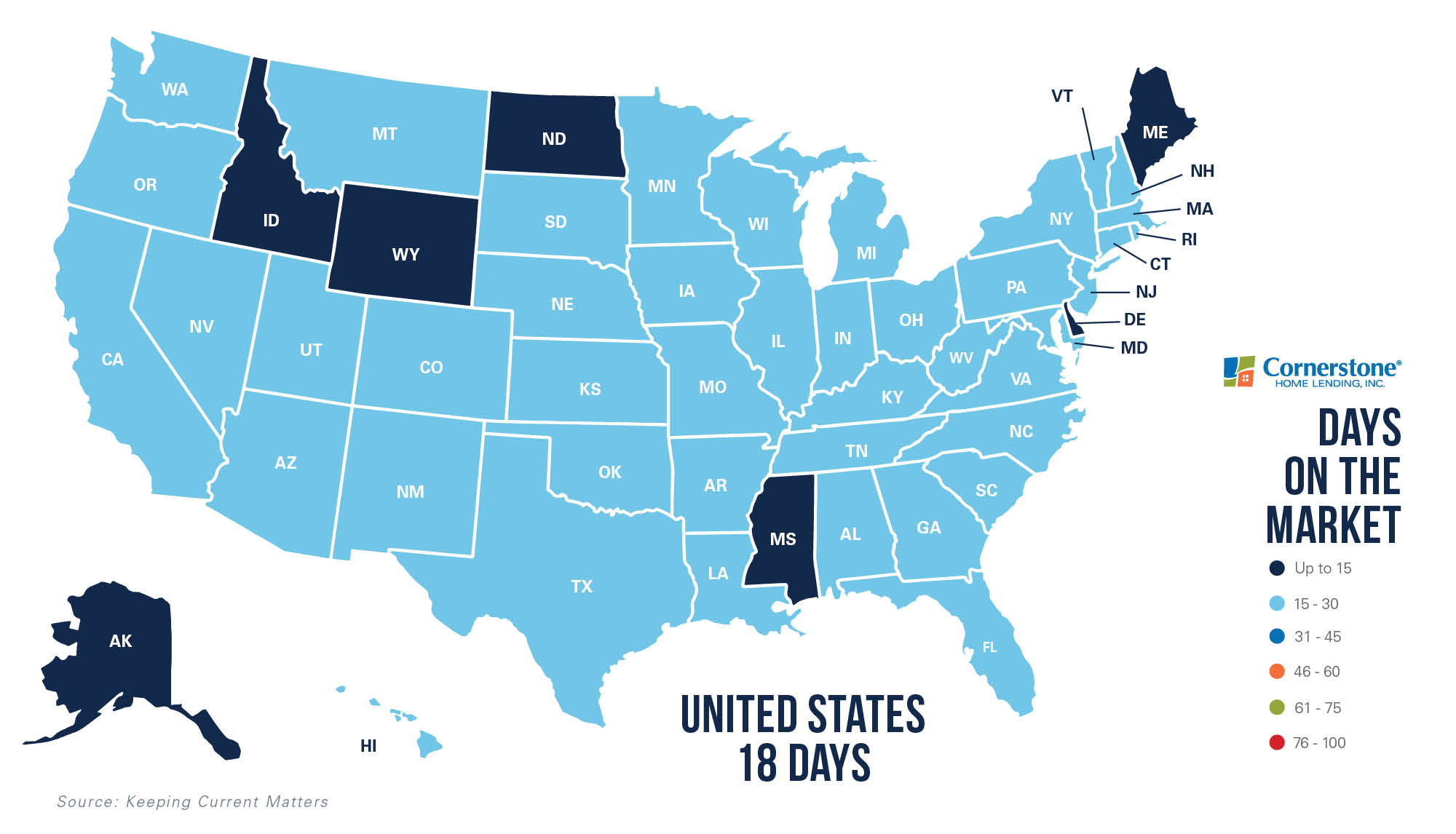

Take a look at the average days on the market for homes in every state:

As far as time to close, cash purchases made up 23 percent of recent home sale transactions. All-cash sales are typically closed in 30 days.

For buyers taking out a mortgage, the latest Origination Insight Report from ICE Mortgage Technology confirms that:

“Time to close all loans decreased in April. The average time to close all loans fell to 51 days in April, down from 52 days in March.”

If you want to close quickly, you won’t find another time in our housing market in which the two steps of receiving an offer and closing on your house have taken this little time. Working with the right mortgage lender can also expedite your closing, potentially shaving weeks off the industry average.

Buying a house would be easy, they said. (And we agree.)

While it’s true that you need to move fast to find your dream home in today’s market, it’s also true that we can help you move faster. Connect with a local loan officer to see how seamless selling and buying a new home can be.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.