Since the real estate market began to bounce back in 2012, there have been plenty of articles written about how residential housing values have risen. But not as much information has been circulated about residential rents. Let’s take a moment to compare.

RentCafe’s 2019 Apartment Rent Report talks about how rent prices have only continued to surge within the past year, related to high demand and low supply:

“Continued interest in rental apartments and slowing construction keeps the national average rent on a strong upward trend.”

Dear renters, landlords grow wealth in their sleep. Click here if you’re ready for a role reversal (and a new place).

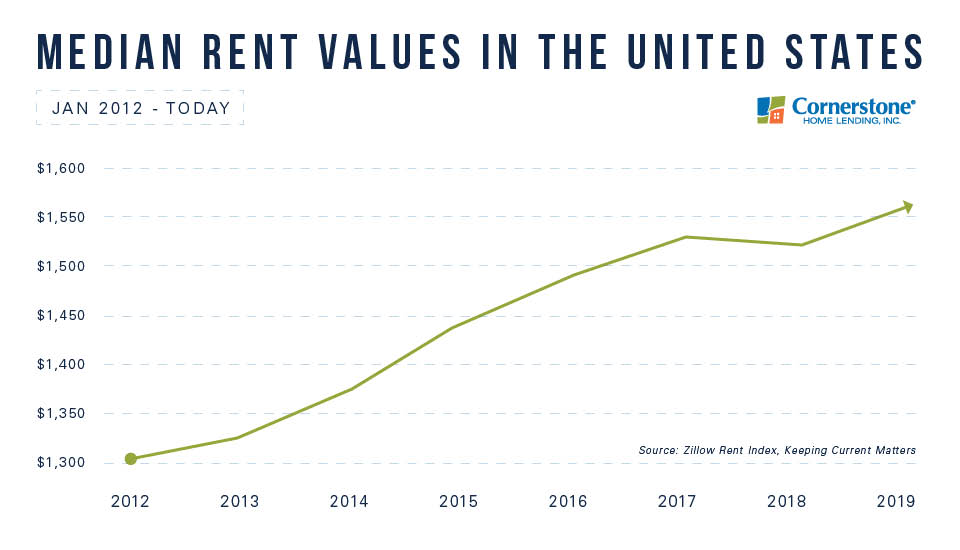

Zillow’s 2019 Rent Index also shows that rents keep moving in an “upward trend” through most of the U.S. — a trend that’s not slowing:

“The median U.S. rent grew 2 percent year-over-year, to $1,595 per month. National rent growth is faster than a year ago, and while 46 of the 50 largest markets are showing deceleration in annual home value growth, annual rent growth is accelerating in 41 of the largest 50 markets.”

The report from Zillow detailed rent increases starting from the time of the housing market’s recovery eight years before. This graph marks the climb:

Housing prices have increased since 2012, adding to the cost of homeownership. (Though it’s important to put this in perspective: It hasn’t been this affordable to buy since 1985.) Right alongside home price increases, the cost of renting has also risen within the same time frame.

A major difference between the two? Buying a home contributes to long-term wealth, leaving many of today’s homeowners with up to $40,000 in “extra” cash-out equity.

Quick question: Do you want to build your investment over time?

Renting can make sense if you need to stay flexible. But just remember, every month you’re paying your landlord’s mortgage. Owning a home works like an automatic savings plan, giving you the chance to cash out for upgrades, debt payoff, school, or vacations in the near future. Self-made millionaire David Bach says homeowners have 40-times more worth than renters.* Why not take the first step and prequalify now?

*“Millionaire to millennials: You’re 40x better off buying than renting.” HouseLoanBlog.net, April 2019.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.