It’s a basic law of economics: Low supply plus high demand automatically causes a price increase. This is precisely what we’re seeing in today’s real estate market. Home values are climbing at nearly historic levels. As a result, hurdles related to home appraisals have also started to arise.

In the past few months, it’s become commonplace for an appraisal to come back under a home’s contract price. As CoreLogic’s Chief Appraiser Shawn Telford explains:

“Recently, we observed buyers paying prices above listing price and higher than the market data available to appraisers can support. This difference is known as ‘the appraisal gap…’”

The more you know, the easier it is to find the right mortgage. Get your questions answered now.

Expect an appraisal gap if you see these market conditions

What triggers an appraisal gap? Essentially, in cases of booming buyer demand, as we’re seeing right now, home purchasers usually bid over asking price in order to “win” their dream house.

If you recently toured a home that you’ve fallen head over heels for, then you probably understand. When you’re able to picture yourself, your family, and your furniture within the four walls of a house, you become motivated to do whatever it takes to secure the property — including placing a higher offer to increase your odds of beating out your competition.

An appraiser who visits the house is bound to have a more objective view. After all, it’s their job to evaluate a home’s current value, so they’ll focus on the facts.

Appraiser Coach Dustin Harris emphasizes:

“It’s important for everyone to understand that the appraiser’s job in the end is to remain that unbiased third party, to truly tell the client what that home is worth in the current market, regardless of what decisions have been made on the price side of things.”

In layman’s terms: While buyers may want to pay extra for a home, appraisers must assess its fair market value. An appraiser’s goal is to ensure that a lender doesn’t loan a borrower more than what a home is worth. This is not emotional; it’s objective.

That said, it’s not uncommon to have a divergence between these numbers in a competitive environment, like our current market.

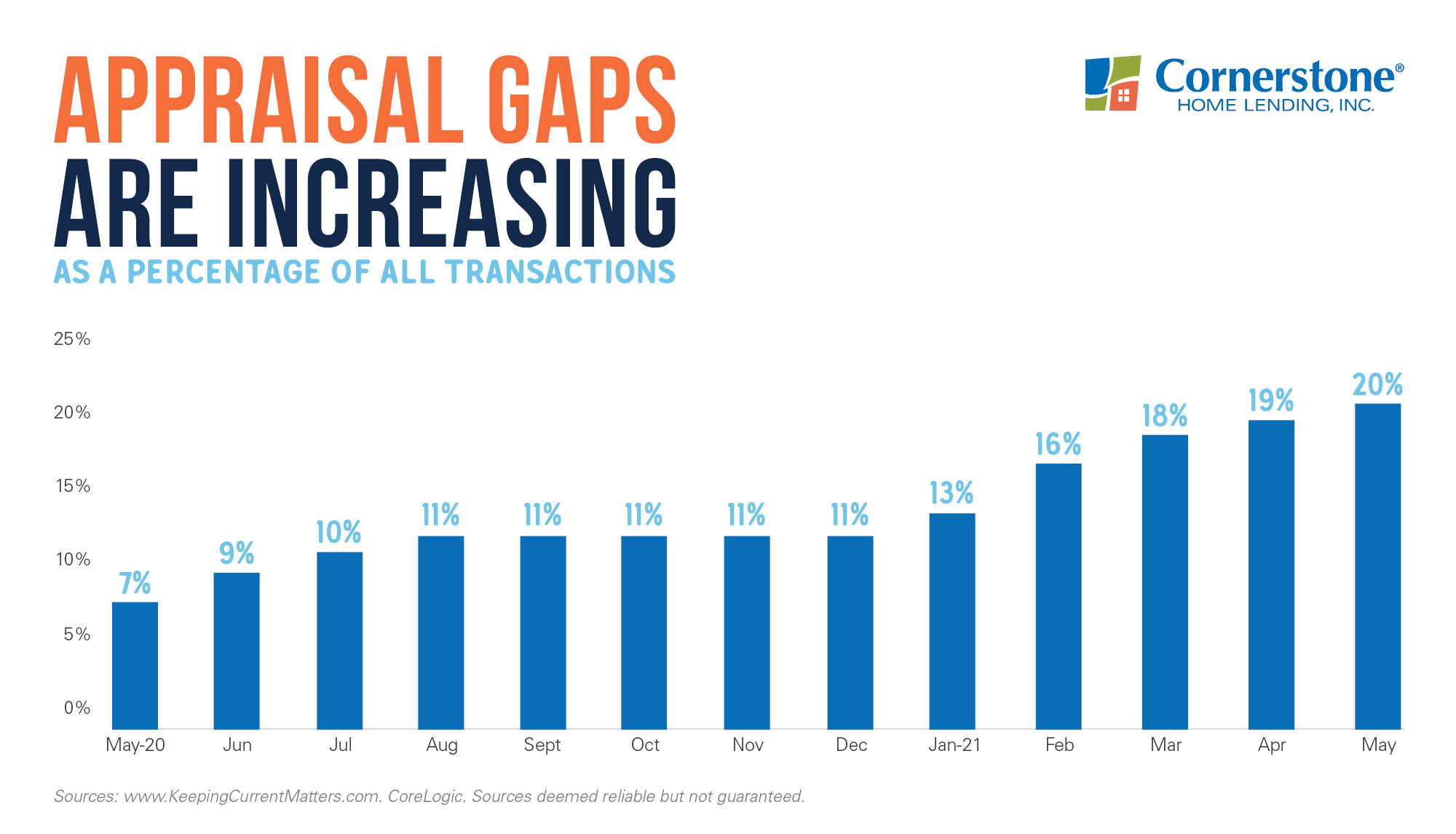

Based on CoreLogic data, this graph shows the rate at which appraisal gaps have been increasing:

How might this impact you as a buyer or a seller? As you know, knowledge is power when it comes to making the wisest financial decision. Understanding what an appraisal gap means for you is essential in today’s market.

In our current market, if an appraisal comes back below contract price:

- It’s common for a seller to request that a buyer pay the price difference.

- Homebuyers, if you want to get the home you have your eye on, know that you may need extra money to close the deal.

Still, paying extra in this market can be worth it. That’s why demand hasn’t cooled, and so many homebuyers remain in the race. Purchasing now, while mortgage rates continue to sit around historic lows, gives you the chance to get a home at an affordable price and immediately start building large amounts of equity.

It’s true. The Federal Reserve’s Survey of Consumer Finances is published every three years, illustrating the difference between a homeowner’s and a renter’s wealth. The findings over the past decade, including 2019’s most recent data, paint a surprising picture.

In 2010, the wealth gap between a homeowner and a renter was $198,000; a homeowner’s wealth was estimated at $203,850, compared to a renter’s $6,010. Fast-forward just nine years later to 2019, and the wealth gap has increased to $249,000; a homeowner now has an estimated $254,900 in wealth, compared to a renter’s $6,270.

First American’s Deputy Chief Economist Odeta Kushi confirms:

“…between 2016 and 2019, housing wealth was the single biggest contributor to the increase in net worth across all income groups…”

Overall, the net worth of the average homeowner is more than 40 times than the net worth of the average renter.

It’s this ability to rapidly build home equity that greatly contributes to the expanding wealth gap between a homeowner and a renter. As home values appreciate, and as a homeowner continues to pay off part of their mortgage every month, equity – and worth – grows.

Even in a competitive market, where demand may drive up a home’s price, it’s still a smart move to purchase. If you’re ready to begin building your wealth, today’s housing market is ripe with opportunities.

Lean on your loan officer for guidance

Today’s highly active housing market can get tricky. Good thing you don’t have to go it alone. Rely on your trusted ally to navigate the market with confidence: Reach out to a local loan officer right now.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.