CNBC recently reported that the average national FICO score has hit its highest point of 706. For potential homebuyers who may be concerned about credit score requirements, this is great news. Many renters may not realize that they’re prepared to purchase a house.

Is the time for homeownership now? Nearly two-thirds of people agree

Today, we’re also seeing mortgage rates reach historically low levels. Because of this, many people — rightly — believe now is an ideal time to buy a house. Fannie Mae’s Home Purchase Sentiment Index® (HPSI) from just a few months ago showed that 58 percent of us say it’s an ideal time to purchase. Likewise, the National Association of Realtors’ (NAR) Q3 2019 HOME Survey confirmed that 63 percent of Americans think now is the right time to buy.

Many times, misconceptions and anxiety are all that are holding motivated and qualified homebuyers back.

The CNBC article also said:

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

In just 10 days, you could be unlocking the door to your forever place. Take the first step and get prequalified.

This news is beneficial for everyone. It shows our nation is improving our credit to support stronger finances in the future, bouncing back from the market downturn of 10 years before. Our current economy is healthy, and wages are increasing. Plenty of people have used this chance to build their credit and drive up the national average within the last few years.

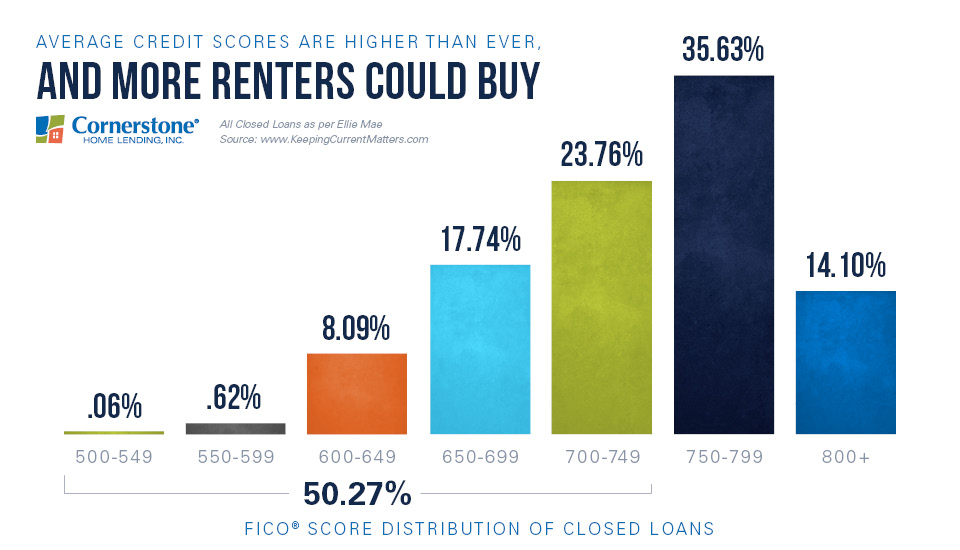

These Americans with healthy credit are now shopping for houses, leading to a rise in FICO Score Distribution for recently closed mortgages:

But wait a minute — it’s important to note that homebuyers don’t necessarily need a 700-plus FICO credit score to qualify.

Experian, one of the three main consumer credit reporting agencies, explained:

- FHA loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10 percent down. If your credit score is 580 or above, you can put as little as 3.5 percent down (but you can put down more if you want to).”

- Conventional loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

- USDA loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

- VA loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

First-time-buyer-friendly loan programs with no- or low-down-payment and flexible credit standards make it possible for many renters to own a home sooner. Even renters whose credit needs some attention could boost their score to meet these requirements within a few months.

Winter renters can actually get a better deal when they buy

Do you want to stop paying your landlord’s mortgage? Ready to begin growing your and your family’s wealth instead? Buying a house gives you the chance to automatically start saving by increasing your home equity. When you house-hunt in the winter, you’re also likely to see lower mortgage rates and seasonal price cuts that may move you up into the next price range. Find out how much more you can afford in this unique season and get your credit score for free.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.