The takeaways:

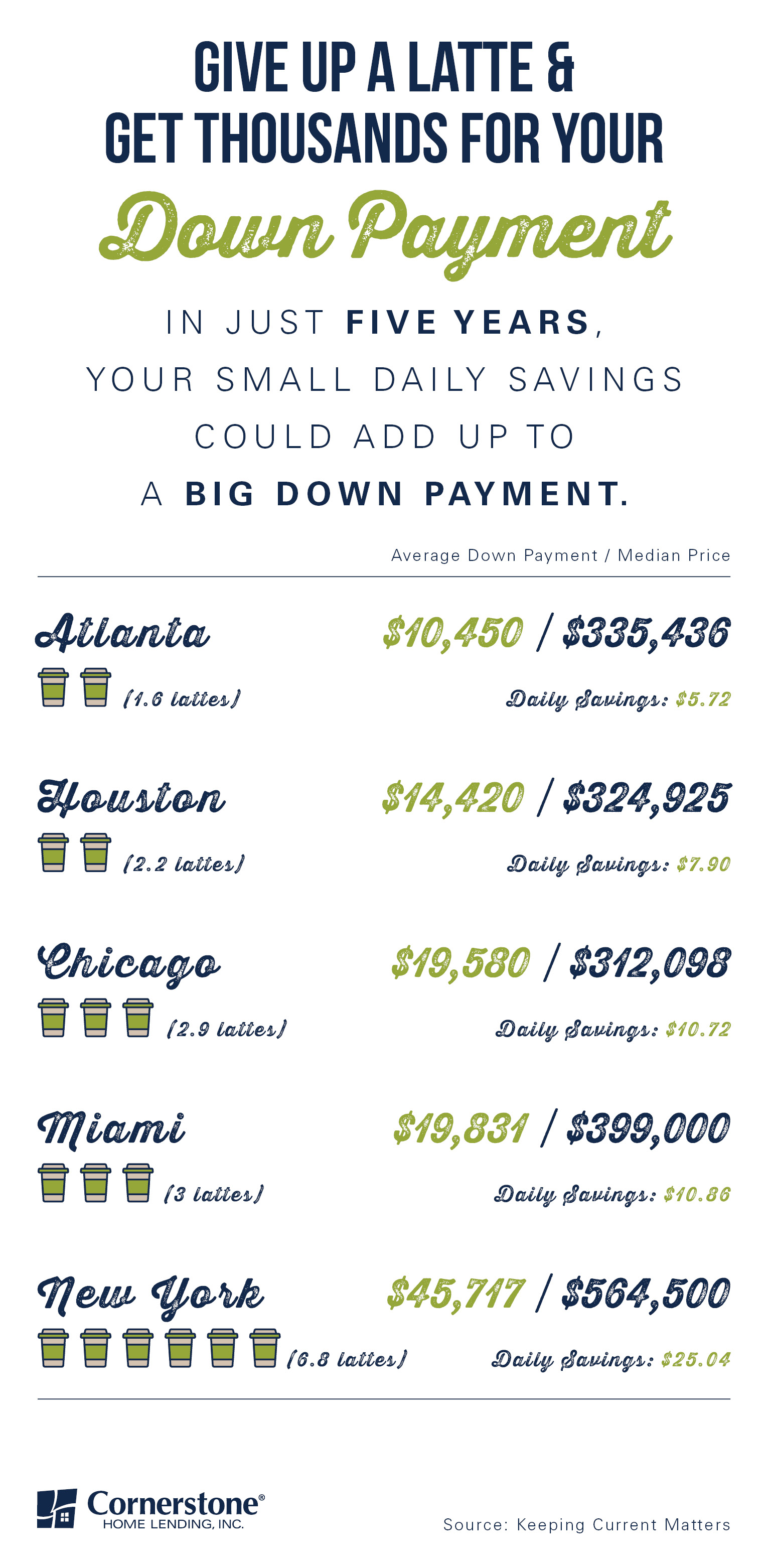

- ‘Tis the season for everything pumpkin spice. It may be tempting to spend a few bucks on your daily coffee habit. But this day-to-day spending can add up to a large sum fast.

- It takes a bit of discipline to save for a down payment. But decreasing unnecessary purchases (like a pumpkin spice latte from the coffee shop that need not be named) will get you to your goal quicker.

- Down payment amounts can vary by location. But setting aside even a small sum each day will push you toward the amount you need for the average down payment without any extra effort.

Down payment savings time is shorter than most homebuyers think

According to Freddie Mac’s 2019 report, Perceptions of Down Payment Consumer Research:

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20-percent down.”

Introducing LoanFly. The way-too-easy, can’t-believe-how-fast-it-was, gosh-I-love-my-loan-officer way to get prequalified for a new home fast.

It’s common for homebuyers to overestimate how much they need to save for a home loan down payment. The same report explains that 22 percent of renters and 31 percent of homeowners believe that the down payment amount for today’s typical mortgage is 20 percent or higher.

It also states:

“If a 20-percent down payment was required, 70 percent of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30 percent indicated they would never be able to afford a home.”

Many homebuyers think a minimum of 20-percent down is needed to buy a new house. This is most often because these buyers aren’t aware of the mortgage programs designed to make homebuying more accessible and affordable, requiring as little as 3-percent down. With the average first-time home loan down payment sitting at just 6 percent, more renters may be able to become homeowners sooner than they expected.

Has the 20% down myth officially been busted?

Twenty percent down — you probably don’t need it. In reality, the down payment requirements for your dream house are likely to be a lot lower. You could even use a low- or no-down-payment mortgage program to get home in 10 days. How is this possible, you ask? Get connected with a local loan officer and find out.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.