Some takeaways to remember:

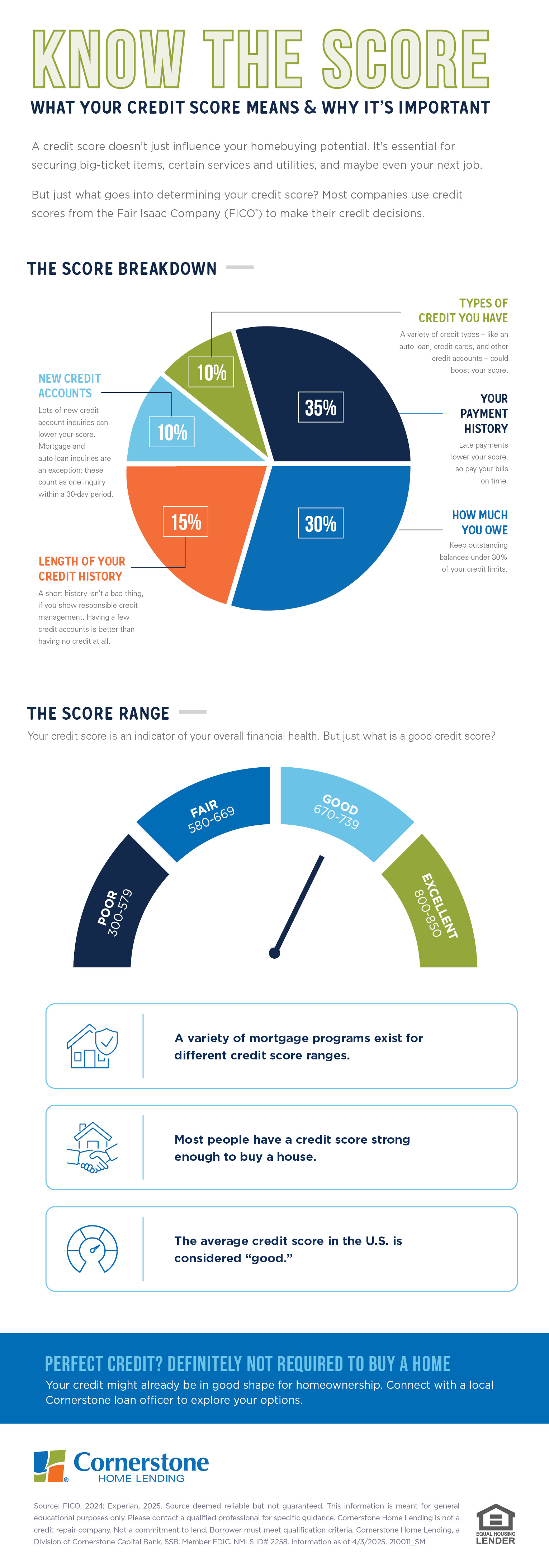

- Your credit score is calculated based on five main factors: payment history, amounts owed, length of credit history, new credit, and credit mix.

- Today’s credit score, AKA the FICO® Score, was introduced in 1989 by the software company FICO. Three major credit bureaus collect your credit data: Equifax, Experian, and TransUnion.

- All scores fall within a 300 to 850 range, with higher being better. Each bureau may have slightly different information about you, which is why your FICO® Score can vary between the three bureaus.

You don’t need perfect credit to buy a home—you just need the right plan. Connect with us to see what’s possible.

How Is Your Credit Score Calculated? FICO’s 5 Factors

Exactly how is a credit score calculated? FICO determines your score based on five factors:

1. Your payment history (35 percent)

How consistently are you making payments? That’s what counts the most. Late payments on all your previous and current credit accounts lower your score, so aim to always pay on time when you’re able.

2. How much you owe (30 percent)

Next up, your balance-to-limit ratio: How much do you owe on all your open accounts? How many balances do you have? How much available credit are you using? The goal here is to lower the percentage of your total credit limit that you still owe, typically aiming to keep card balances to less than 30 percent of their limit.

3. Length of credit history (15 percent)

The longer you’ve had active credit and made timely payments, the better your score will be. There’s not much you can change about how long you’ve had credit, but you can make a positive impact by managing your finances responsibly moving forward. Small steps today can lead to big improvements.

4. New credit (10 percent)

Whenever you open a new line of credit, an inquiry is performed that negatively affects your score. The only exception is when you’re shopping for a home. All mortgage inquiries within a 30-day period count as a single pull. To maximize your score, minimize hard inquiries.

5. Credit mix (10 percent)

Having a diverse mix of credit accounts shows that you can manage different types of debt. This includes revolving credit, like credit cards, and a mortgage, car loan, and student loans. Still, it’s probably not a good idea to open a lot of new accounts just for this reason as this could hurt your score in the short term.

What Credit Score Do You Need to Buy a House?

Many mortgage programs exist for different types of credit:

- VA, FHA, and USDA loans offer low or no down payment options with flexible credit minimums starting at 500.

- Typically, mortgage programs require a credit score less than 700; this means most homebuyers have a credit score high enough to qualify for a home loan if they meet other requirements.

Your credit score may be checked when you apply for a mortgage, rent a home, apply for a credit card, buy insurance, or set up utilities. A mortgage lender will typically draw reports from all three credit bureaus, often using your middle or lowest score to determine if you qualify.

Your FICO Score affects your approval and your interest rate. A higher credit score may qualify you for a lower mortgage rate. Lowering your mortgage rate even slightly has the potential to save you thousands of dollars over the life of your mortgage. Getting to know what goes into your score gives you the chance to save money by working to maintain it or improve it.

Take the First Step Toward Better Credit

One of the first steps to bettering your credit score is viewing your credit history. There’s no reason not to do it since you have access to a free copy from all three reporting companies once a year at AnnualCreditReport.com.

You can also contact bureaus individually:

Keep in mind that companies that charge for credit reports aren’t only charging added fees. They often provide less accurate information than the three main credit bureaus.

Once you get your reports, review them carefully. Check for incorrect or late payments, credit limits, missing accounts, and fraud. If you see any mistakes, notify the credit bureau within 30 days of the report date. There’s no cost for setting the record straight—it’s your right.

Concerned about your credit score?

That’s what we’re here for. Reach out to a local Cornerstone loan officer to assess your score and come up with a homeownership plan.

Sources deemed reliable but not guaranteed. For educational purposes only. Cornerstone Home Lending does not provide credit repair services. Please contact a qualified professional for specific guidance.