Almost across-the-board, research proves that the biggest asset a family can have is the home they’re living in. Within just the past 12 months, this asset has increased in value.

If you’re like most homeowners, you’re sitting on some cash

CoreLogic’s Homeowner Equity Insights Report, released in the third quarter of 2019, stated that:

“U.S. homeowners with mortgages (roughly 64 percent of all properties) have seen their equity increase by a total of nearly $457 billion since the third quarter 2018, an increase of 5.1 percent, year over year.”

This property equity is calculated by comparing current property values against existing mortgage debt. As home prices increase, a home’s equity will also rise.

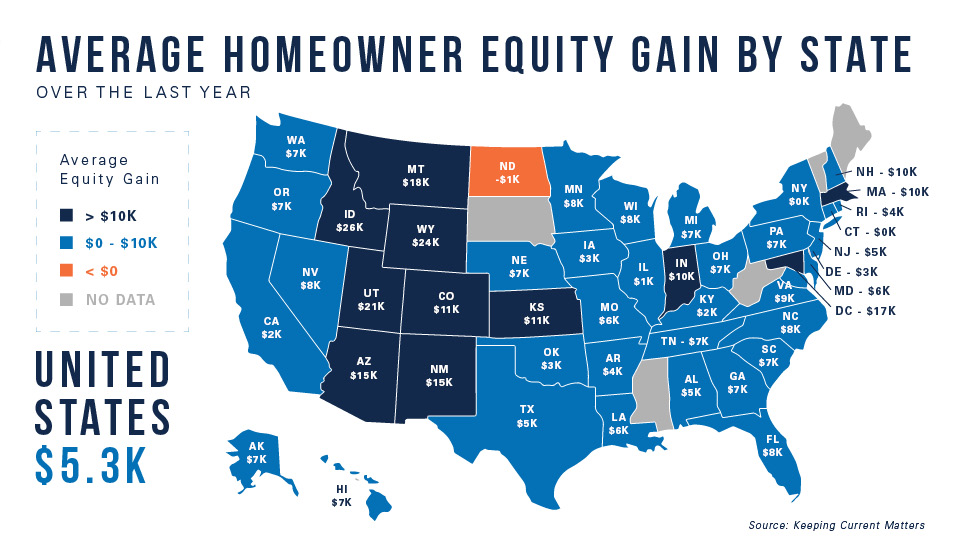

As the report explained, the average homeowner gained $5,300 in home equity within the last year.

What could you do with an extra $5,300? Get prequalified to find out if your equity boost could move you into a new price range.

This map reflects home equity gains averaged by state:

It’s true that many homeowners felt trapped in their current homes after the housing market crash of 2008. Back then, there wasn’t enough equity to sell. But the significant equity gains within the last few years have given many of these homeowners back their freedom, offering the cushion needed to move up or even pay for healthcare, emergency funds, and household expenses.

Get the cash you need in times like these

Consider a cash-out refinance in a crisis: If your home equity has gone up, you can tap into it for the extra cash you might need right now. Your physical and financial health always come first. Connect with a local loan officer by phone, email, app, or video.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.