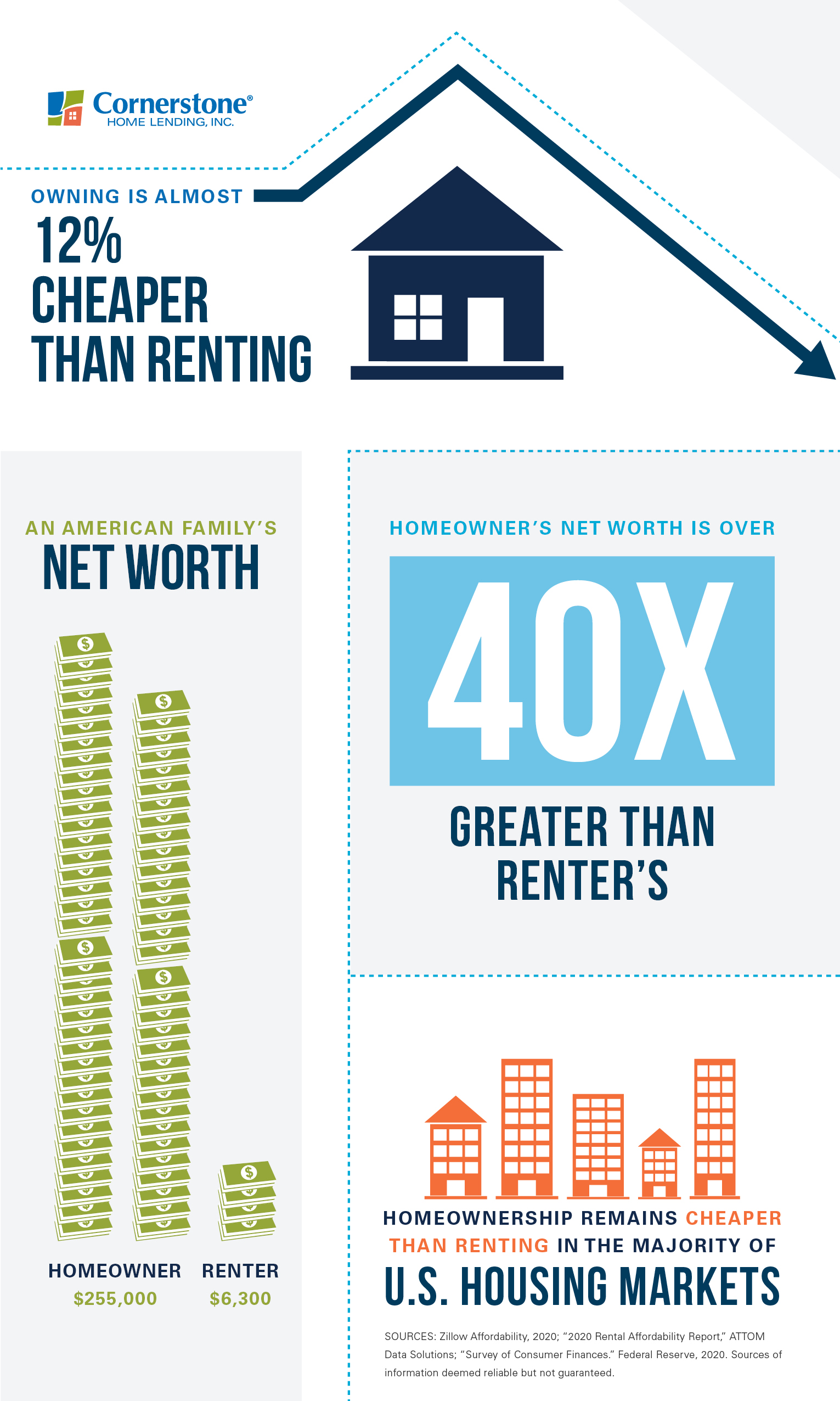

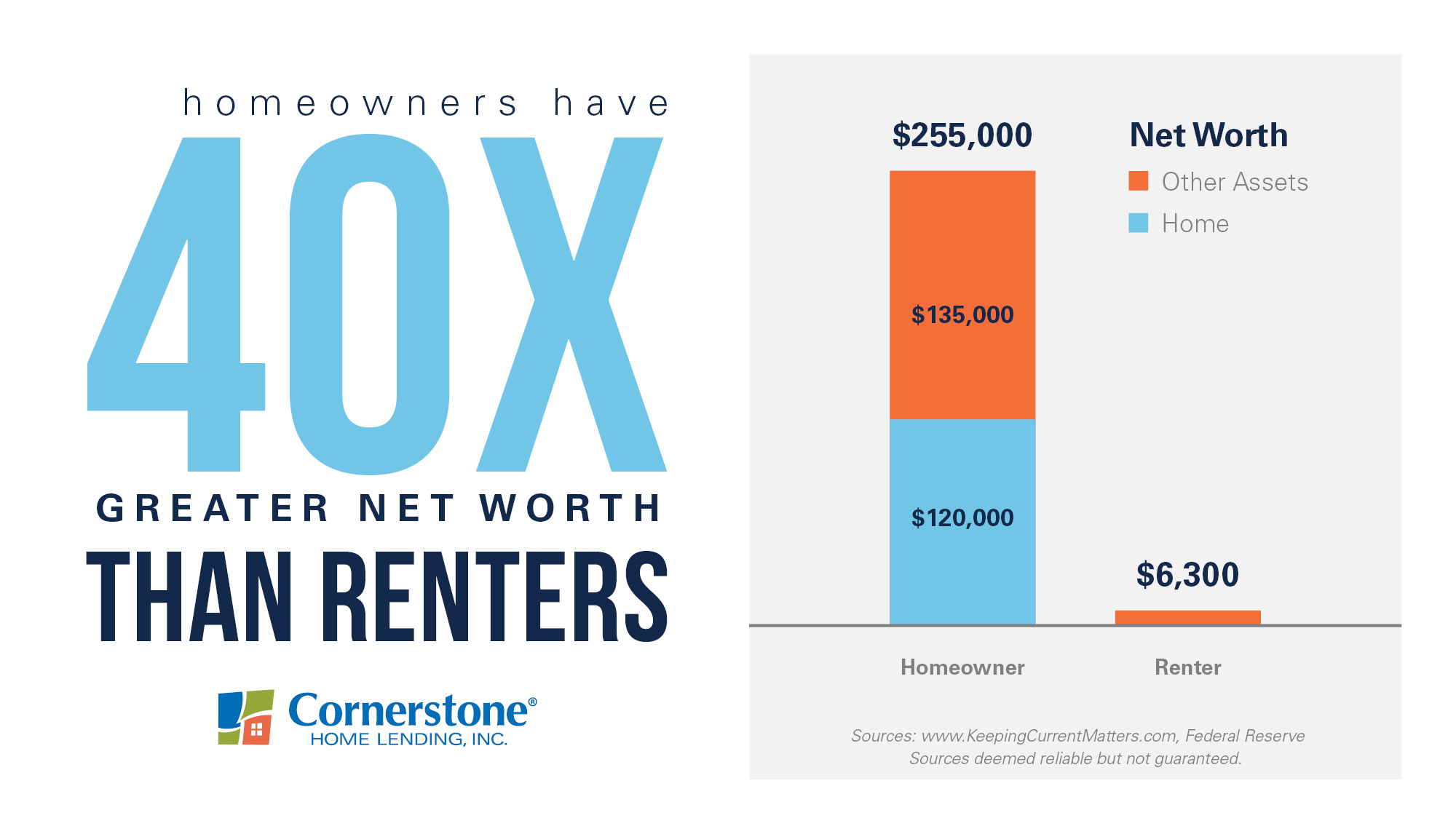

Owning a home is known to be one of the most effective ways to build a financial future for your family. As the latest Federal Reserve data shows, a homeowner’s net worth is actually over 40-times greater than the net worth of a renter. With home affordability at a high, it may be smart to start hunting.

Increase your family’s wealth without trying?

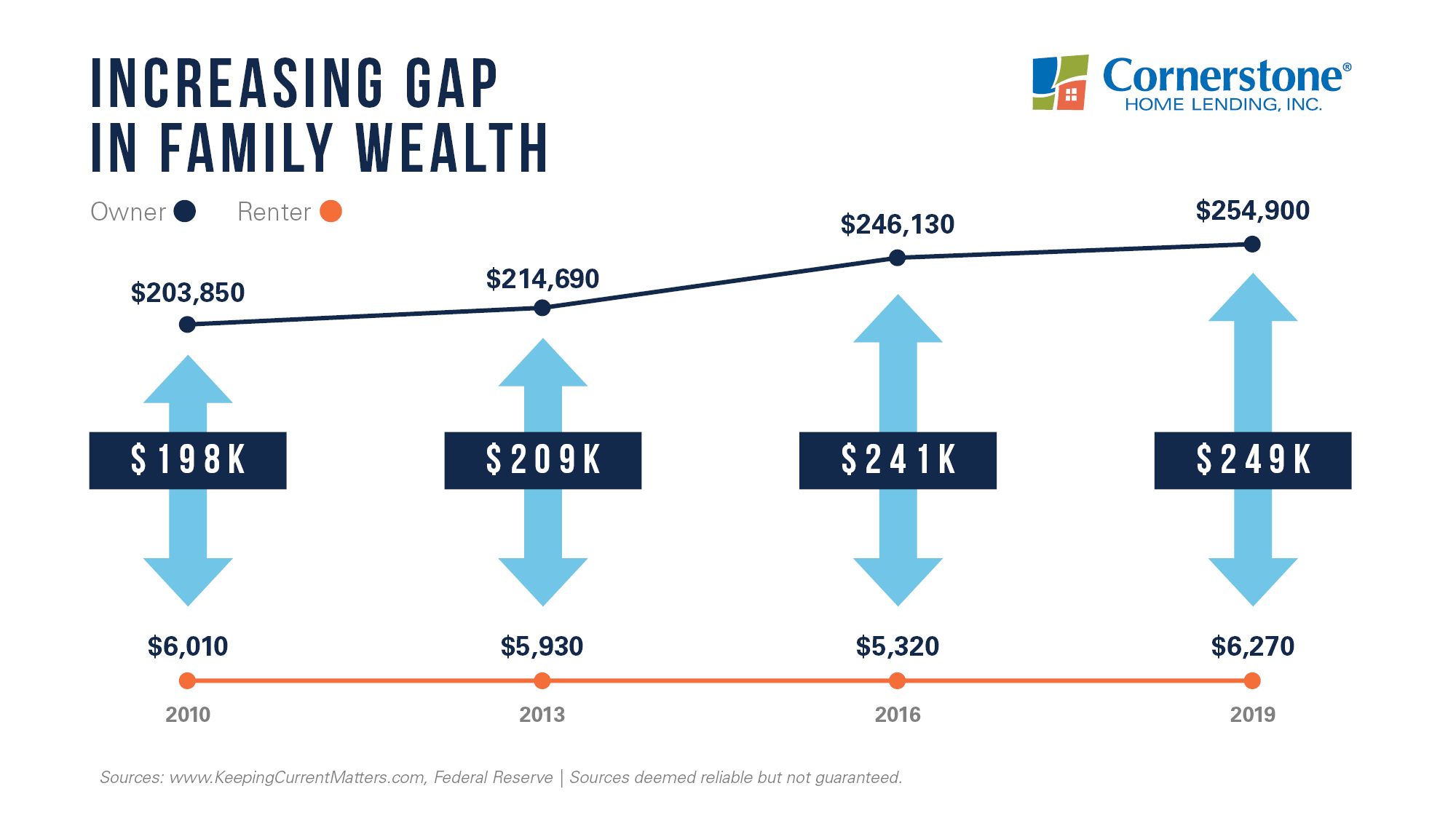

The Federal Reserve’s Survey of Consumer Finances is conducted every three years. Data from all social and economic groups are collected. The most recently released survey spans 2016 to 2019.

This is what study results showed:

A homeowner’s median net worth is about $255,000, up nearly $9,000 since 2016. Within the same time frame, a renter’s median net worth also rose to $6,270, an increase of $950.

The numbers confirm that a homeowner’s net worth is more than 40 times that of a renter:

Homeownership has been called a “forced savings plan.” Whenever you pay your monthly mortgage, you’re contributing to your family’s net worth, not your landlord’s. You do this by increasing your home equity.

We make buying a house too easy. Get prequalified from anywhere.

This is why homeowners in the U.S. chose real estate as the number one long-term investment for seven consecutive years, according to a recent Gallup poll. The latest results revealed that 35 percent of Americans picked real estate, followed by stocks at 21 percent and then savings and gold.

Today’s housing market has big opportunities for homebuyers. Not only has it fully recovered, but all-time-low mortgage rates have given homebuyers close to a $32,000 purchase power increase. Buying a home this fall, a season when demand typically slows, could set you up to successfully grow your family’s worth and build a safety net for your future.

You could already be home by now

There’s a simple solution for homebuyers who want to start increasing their wealth, like yesterday. Work with a lender that can get you home faster. Our smooth, quick, and easy closing process cuts down or eliminates mortgage delays almost completely. A speedy closing can save you money upfront and also give you more time to start building your equity.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.