Each year, Americans decide whether it’s time to renew another lease or take the plunge to become a homeowner. This can involve looking at income and savings and then determining what finances allow for. It’s also likely that this equation will factor in monthly housing expenses, tax breaks, and other add-on costs.

With all this in mind, the latest studies still show that it’s cheaper to own a home than to rent in most areas of the U.S.

That’s not all: There’s another financial benefit of homeownership that’s often overlooked — the wealth you’ll grow by owning a home in the form of home equity.

I want to buy a house: How much equity can I expect to gain?

As First American’s Deputy Chief Economist Odeta Kushi recently explained:

“Once you include the equity benefit of price appreciation, owning made more financial sense than renting in 48 out of the 50 top markets, with the only exceptions being San Francisco and San Jose, Calif.”

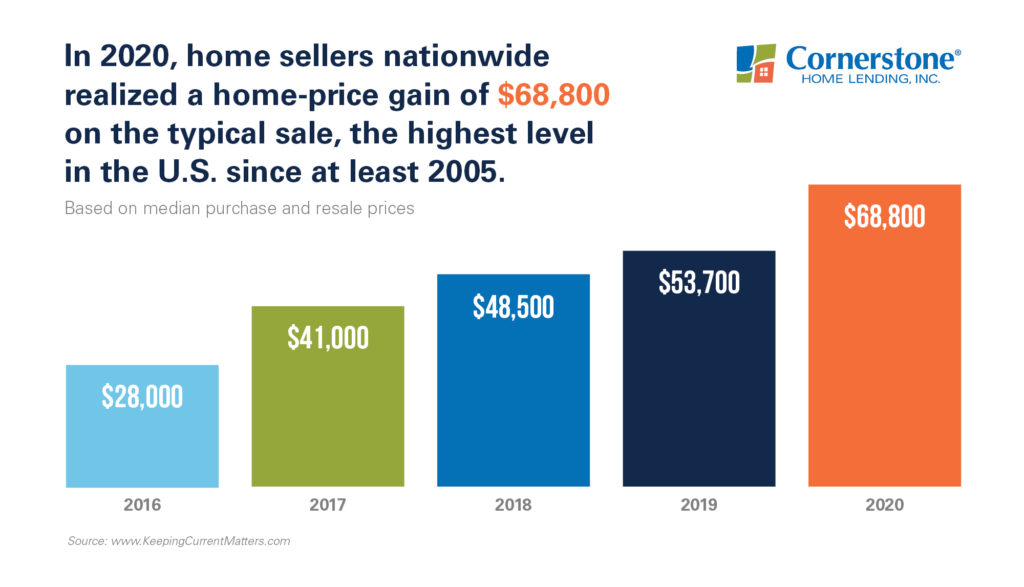

ATTOM Data Solutions — responsible for one of the top property databases nationwide — also just assessed the average home-price gain for U.S. homeowners who sold their houses.

This is what they found:

The sooner you buy, the quicker you can start building your equity. See how LoanFly makes homebuying a breeze.

In the past five years, the typical home equity gain in a sale has risen dramatically. CoreLogic — another curator of property data — recently published their Homeowner Equity Insights Report. It showed that the average homeowner earned $17,000 in equity within the past 12 months alone.

So, what can homeowners anticipate for the future of their equity?

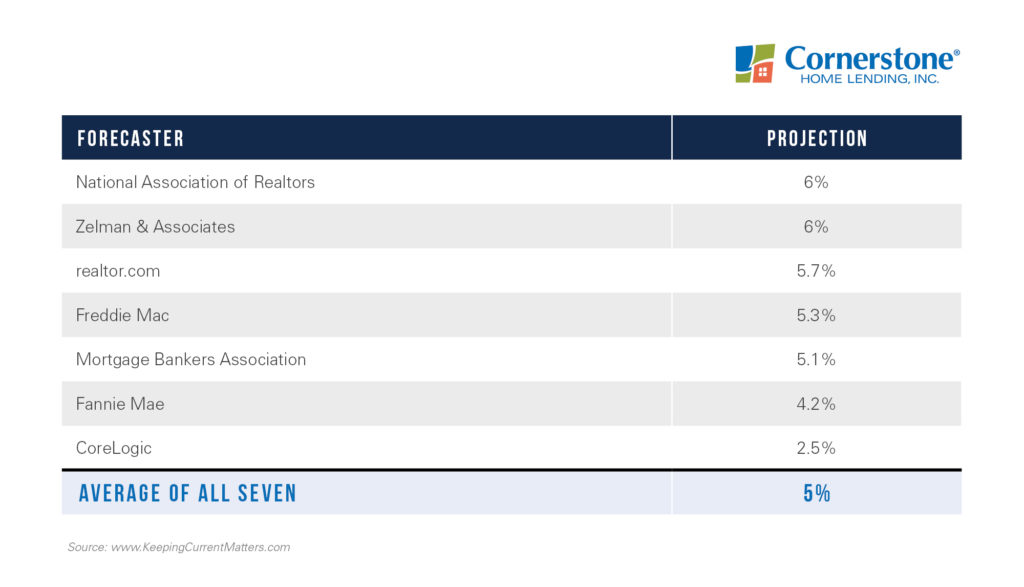

This is what seven major authorities are forecasting for home prices in 2021:

According to the National Association of REALTORS® (NAR), the median-priced home in the U.S. sits at $309,800. Should homes appreciate by 5 percent in 2021 — as forecasted — then a homeowner’s wealth will increase by $15,490 this year due to rising equity.

There are a few other strong reasons to consider homeownership today:

- Mortgage rates have begun to increase but are still sitting around record lows, making it a historically affordable time to buy.

- You may also be spending more time at home and, thus, requiring more space for remote work and schooling.

- Along with this may come the need for more outdoor space – which could be limited or shared if you’re renting.

It’s a common argument that renting does away with extra expenses like home repairs and property taxes. But it’s important for prospective renters to know that all these extras that a landlord pays are lumped into your final monthly rent — also padded for profit. Renting doesn’t save you money.

When First American compared the net worth of renters and homeowners based on income, only one category (those earning $127,000 to $192,000) yielded a greater net worth for renters. Homeowners came out on top in all other categories, showing higher wealth gains.

As you weigh whether you should rent or buy this year, make sure to count the cost benefits of increasing home equity. If other financial factors fall into place, this is an ideal time to become a homeowner and see the rapid growth of your investment.

Let’s make mortgage friendly (and fast and easy) again

No more waiting around on paperwork and getting frustrated by unnecessary delays. LoanFly puts you in the driver’s seat — and gives you back control over your mortgage. Use our free app to stay connected with your local loan officer, keep tabs on your loan’s progress, and fast-track your mortgage to closing day.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.