We’re right in the middle of the longest economic recovery period in U.S. history. The stock market has reached never-before-seen highs, and unemployment rates have hit new lows. Once again, home price appreciation is starting to accelerate. Now, everyone’s asking: How long will this economic growth continue?

Nearly 30% of experts say: Don’t worry about the next recession until 2021

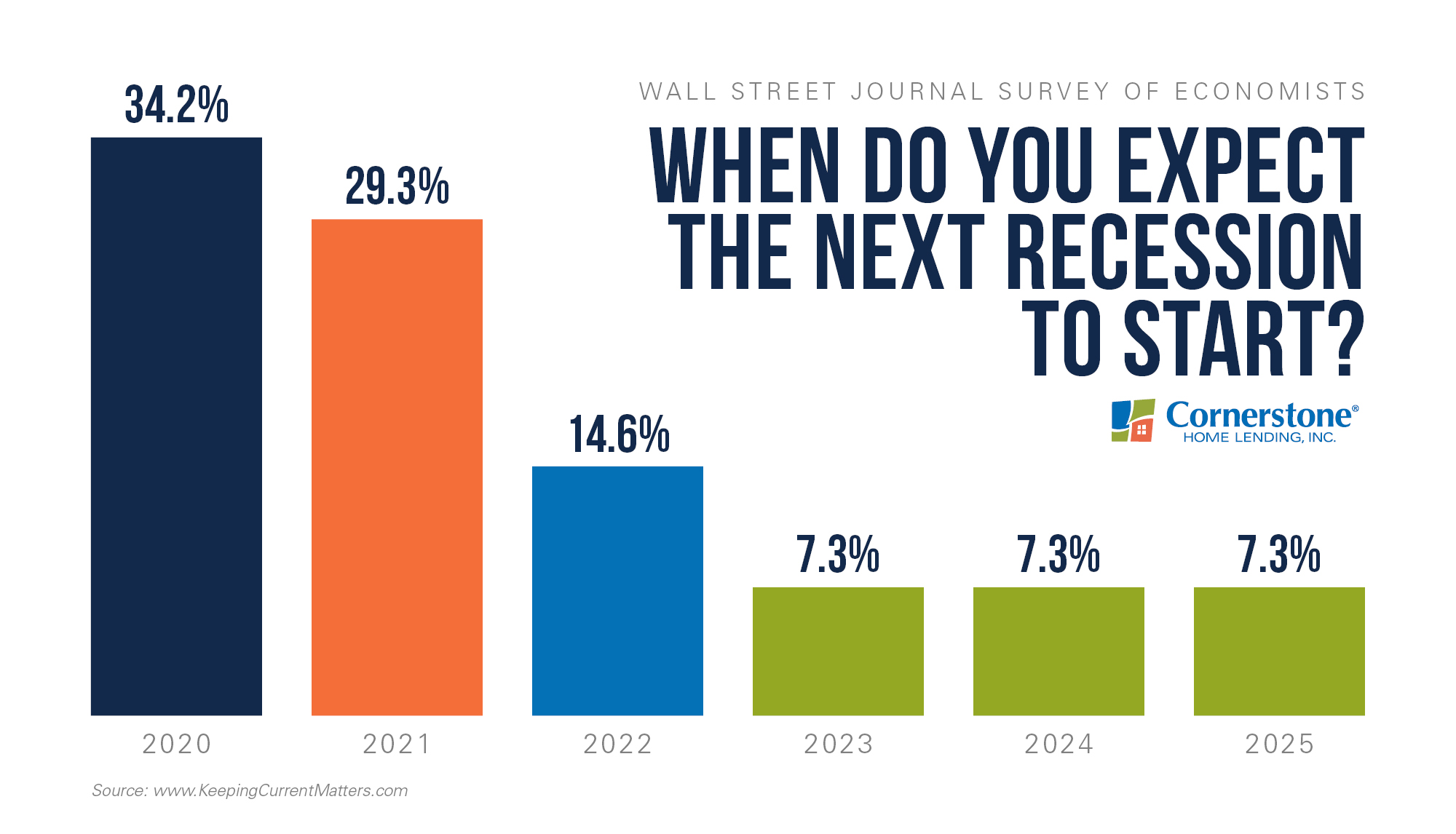

Recently, the Wall Street Journal (WSJ) Survey of Economists predicted a recession, or an economic slowdown, on the horizon. But the latest survey shows something different. Economists are pushing back their estimations. Originally, 42.5 percent of the WSJ economists said they anticipated that a recession would begin starting now and through 2020. The latest survey showed that number decrease to 34.2 percent.

This is currently what economists are projecting:

From “should I?” to “let’s do this:” Get prequalified in minutes, and once you find a home you love, we’ll get you there in 10 days.

Along with a strong economy, the homeownership rate in the U.S. is also rising, indicating healthy housing market growth.

In 2019’s third quarter, the U.S. Census Bureau said:

“The homeownership rate of 64.8 percent was not statistically different from the rate in the third quarter 2018 (64.4 percent), but was 0.7 percentage points higher than the rate in the second quarter 2019 (64.1 percent).”

Many areas of the country are still seeing an inventory shortage, especially among starter and mid-range homes. But this isn’t holding motivated buyers back. Today’s record low mortgage rates are also about a third of what they were in the 1980s and half of those seen in the 1990s. As a result, both first-time and repeat buyers who purchase during this time of economic stability could expect to pay roughly $700 to $1500 less for their monthly mortgage.*

Tired of living in limbo? This could be your year to buy

Whether you’re renting when you’d rather be owning or are ready to sell and move to the home that feels just right, current economic conditions show that this is an ideal time to purchase. But where to start? Connect with a local loan officer, find out if buying or selling makes sense for your life, and learn about our many affordable loan programs that can make your mortgage cheaper.

*”The Cost Across Time [INFOGRAPHIC].” Keeping Current Matters, Nov. 2019.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.