What better way to celebrate the season than with the gift of financial stability? Especially with the year we’ve had. Right now, there’s a silver lining for American homeowners. The average amount of home equity only continues to increase.

2 reasons rising equity is a really good thing: It helps you and others

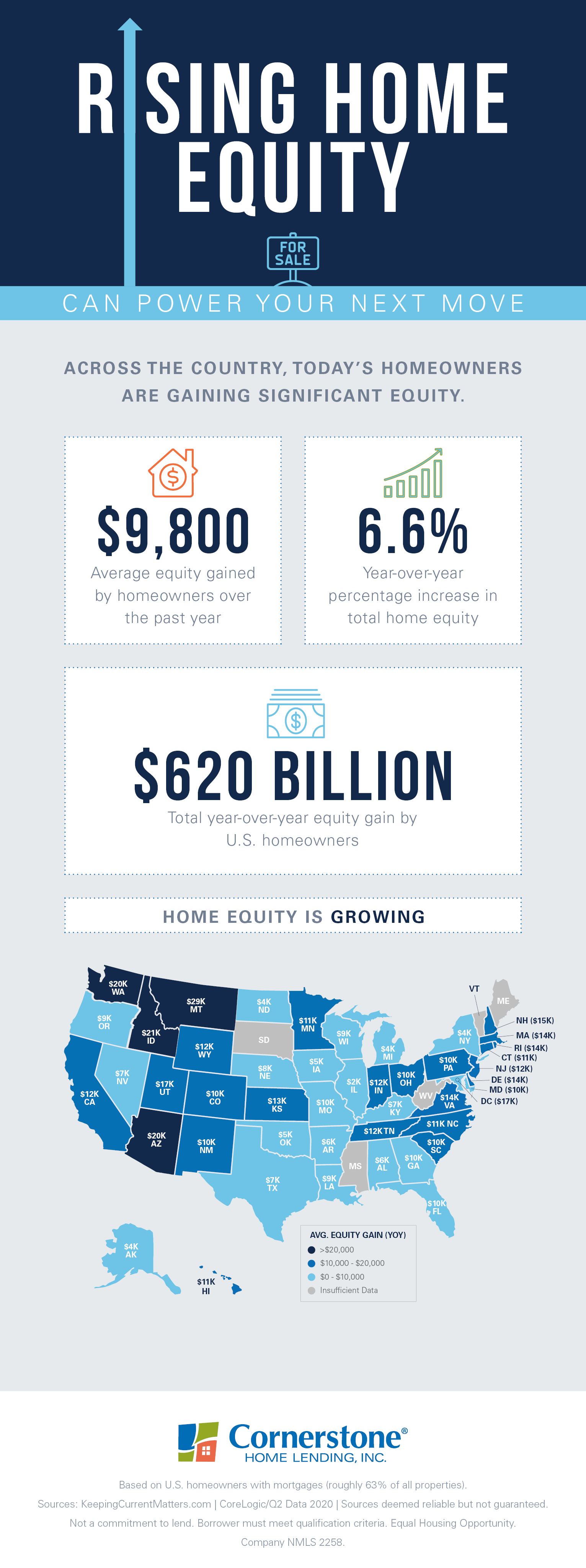

As CoreLogic’s recent data show, the average homeowner has gained $9,800 in home equity within the past year. On top of that, housing experts predict that home prices in 2020 will keep rising. As these prices go up, equity gains will follow.

Black Knight has reported that:

“The annual percent change in the overall median existing single-family-home price has skyrocketed in the past several months, with recent numbers at three to five times higher than rates seen in the past several years.”

Jeff Tucker, Zillow’s Senior Economist, confirmed that this unprecedented price growth is “jaw-dropping” and “within a hair’s breadth of double-digit year-over-year appreciation.”

Today’s homeowners are in a great position to tap into this surge in equity, accessing support to help weather the ongoing economic and health crisis.

For homeowners, increasing equity brings two big benefits:

1. Equity boosts a homeowner’s buying options.

The past eight months have brought financial damage to many, along with immense emotional upheaval. Lockdowns, shelter-in-place orders, quarantine, and remote schooling have caused us to rethink the functionality and space we require from our house. Knowing this equity is “in the bank” may give you the leverage to move up from your current home or build a brand-new one that better suits your needs and wants.

Recently, Mark Fleming, First American’s Chief Economist, said:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity.”

If you’re considering a move, the amount of equity you have in your house right now could make that happen.

Ready to refinance without the hassle? Click here to get started.

2. Equity helps homeowners support future generations.

A spike in home equity doesn’t just benefit one homeowner. Rising equity grows collective wealth, which can spill over onto future generations.

As the Federal Reserve recently explained in their addendum to the Survey of Consumer Finances:

“There are numerous ways families can transmit wealth and resources across generations. Families can directly transfer their wealth to the next generation in the form of a bequest. They can also provide the next generation with inter vivos transfers (gifts), for example, providing down payment support to enable a home purchase or a substantial wedding gift.”

The Federal Reserve also detailed another means by which wealth — including the extra net worth produced by a surge in equity — can help generations to come:

“In addition to direct transfers or gifts, families can make investments in their children that indirectly increase their wealth. For example, families can invest in their children’s educational success by paying for college or private schools, which can in turn increase their children’s ability to accumulate wealth.”

Equity can be used to help a homeowner build their confidence at a time of widespread financial instability. In the short-term, it provides more options to move up. In the long-term, it helps make a positive impact on the next generation.

The largest single investment you have is likely to be your house. As this investment appreciates, your financial opportunities grow too.

There’s still time to tap rising equity that’s only expected to increase

Along with significant equity gains, mortgage rates remain at historic lows, adding yet another reason to refinance. If you’d like to surprise your family with savings for the holidays — potentially slashing several hundred dollars from your monthly mortgage — now’s the time to prequalify and learn about your options.* So, is it a good time to refinance? Finding out only takes a few minutes.

*“Your life looks nothing like it did a year ago: Why does your mortgage?” Oct. 2020.

While refinancing could make a significant difference in the amount you pay each month, there are other costs you should consider. Plus, your finance charges may be higher over the life of the loan.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.