Over the last year, many homeowners reaped the benefits of a seller’s market. Home prices appreciating at record levels, surging equity, tight inventory, and historically low mortgage rates gave homeowners the motivation to move into new homes that better fit their changing, often remote, lifestyles.

So, what about now? Does selling still make sense?

The latest realtor.com data confirms that a large number of homeowners plan to list their homes this winter. As a result, more houses are expected to enter the market, offering more options for homebuyers.

George Ratiu, realtor.com’s Manager of Economic Research, says:

“The pandemic has delayed plans for many Americans, and homeowners looking to move on to the next stage of life are no exception. Recent survey data suggests the majority of prospective sellers are actively preparing to enter the market this winter.”

If you’re a homeowner who’s waiting to list until the spring, keep in mind that your neighbors might beat you to it. Selling in the winter — typically considered the slowest season — offers you the chance to set yourself apart and grab the attention of still-active homebuyers.

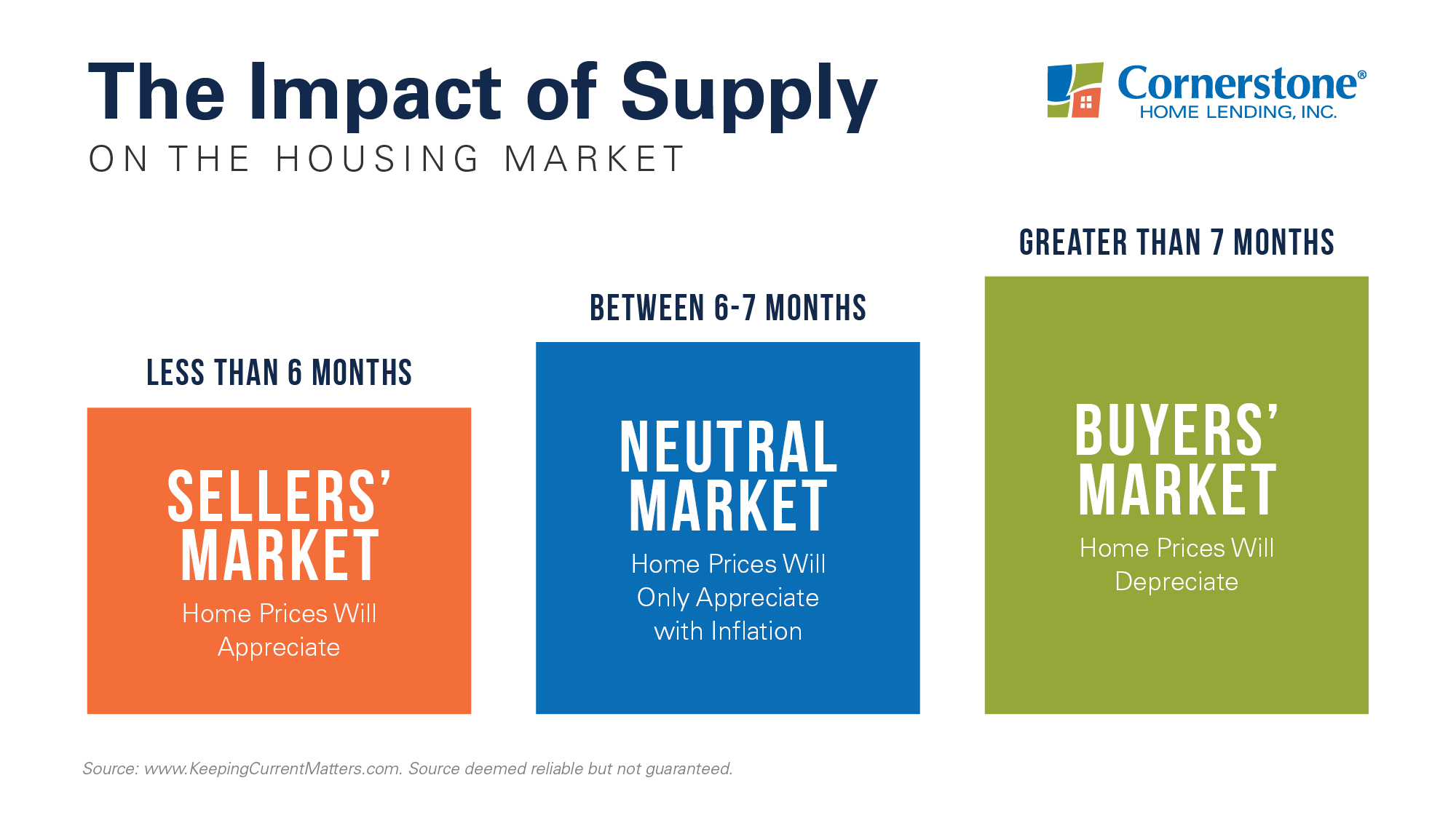

That’s right: Buyers remain active, and sellers continue to have the upper hand. This is due to the fact that a six-month supply of available houses for sale is required to sustain a neutral/normal market.

Conditions shaping today’s seller’s market are depicted in the graph below:

According to the most recent Existing Home Sales Report from the National Association of REALTORS® (NAR), there’s a 2.1-month supply (inventory) of homes for sale. This falls far below what characterizes a neutral housing market.

If you’re a homeowner, consider that: When current inventory levels are this low, it becomes a lot more difficult for homebuyers to find houses. This supply shortage creates competition, causing house-hunters to put in aggressive offers so they can beat out other buyers.

Home prices will increase, as a result, and so will your leverage as a seller. In today’s seller’s market, you’ll be in the driver’s seat and have more power to negotiate.

No one ever said selling a house had to be hard. Get prequalified for your next mortgage from anywhere.

While it will take time for low housing inventory to level out, selling a house now can help you maximize your potential – and your profit. Current data shows that more homeowners anticipate listing this winter; selling your home sooner gives you the chance to separate from the pack.

Sell to trade up + 3 more ways to cash in on your equity

As a homeowner, you might already be familiar with the astonishing rate at which your equity has recently increased. CoreLogic’s Equity Insights Report shows that the average homeowner gained $56,700 in home equity within the last year.

One way to use this equity is to sell your home and move to a house that better meets your current needs. After transitioning to remote work, you might be short on space and could benefit from trading up to a larger house with a home office. Or, you might want to consolidate by downsizing to a smaller house that requires less maintenance.

You can also use your equity to:

1. Move to your dream location.

Maybe your home’s size isn’t the problem, but you could use a change of scenery. Working remotely in a seller’s market means that now may be the time to make dreams come true — by relocating to the beach, the mountains, or another city where you’ve always wanted to live. (Some cities will also pay you to move there.)

2. Start your own business.

If it’s not the right time to make a move, you can cash in on your equity to fund a business venture. The U.S. Small Business Administration Office of Advocacy confirms:

“There is an estimate of 31.7 million small business owners in the United States, many of them started their business with the equity they had in their home.”

Though it’s typically not recommended to tap into home equity for unnecessary expenditures, using equity to branch out into your own business presents an opportunity for you to grow your net worth (your nest egg) even more.

3. Subsidize education.

Whether you’re wanting to go back to school yourself or to support a loved one heading off to college, higher education can be an investment. In both cases, you can cover some of the costs by tapping into your newfound equity. You’ll be putting your equity gains directly into your or your loved one’s future.

If you want a ‘seamless experience’ when buying your next house:

“They were so patient with me (and all my questions… and lack of computer skills) through the whole process. Everything was on time and always cordial and informative in responses.” Reach out to a local loan officer now.

While refinancing could make a significant difference in the amount you pay each month, there are other costs you should consider. Plus, your finance charges may be higher over the life of the loan.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.