Have you spent some time working remote this year? Odds are, as health officials are still trying to contain the pandemic, you’ve been working at home longer than you first anticipated. To keep doors open and team members productive and safe, businesses across the U.S. have started to operate remotely — without an end in sight.

Move to a new area, get a better house?

This unexpected shift has caused Americans everywhere to rethink what they need — and desire — from their living space, whether it’s a change of location, floor plan, or size. Some remote workers require extra room, especially when kids are learning at home. Others want to downsize.

Whether you rent or own your house, you might be considering a move while mortgage rates are at record lows to better accommodate remote work for the future.

Crunch the numbers and find out if you should rent or buy.

You’re not alone. Upwork’s recent study confirms that:

“Anywhere from 14 to 23 million Americans are planning to move as a result of remote work.”

To paint a clearer picture, 6 million U.S. homes sold last year. Right now, in comparison, about 2 to 4 times the amount of people are thinking about moving, directly connected to their transition to working at home.

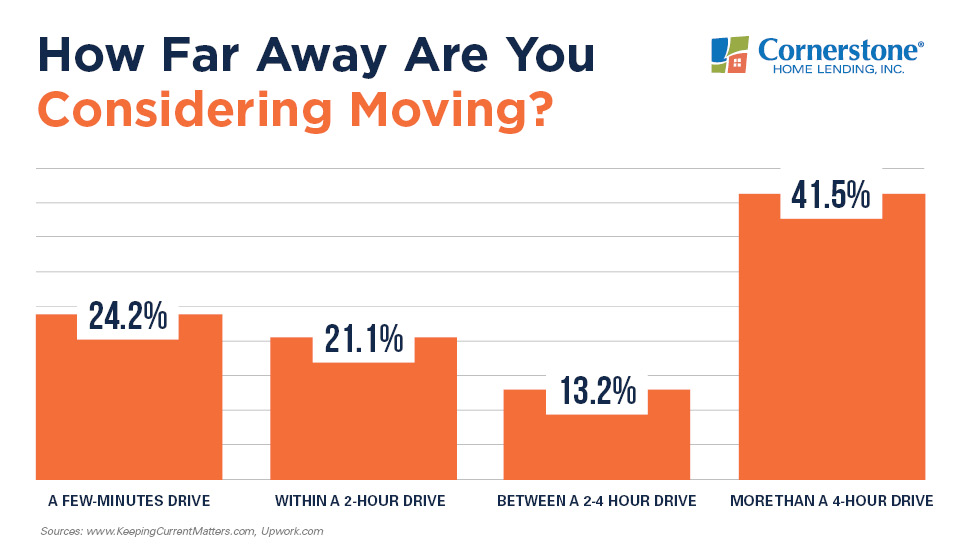

Roughly 45 percent of these workers plan to remain within a two-hour driving distance from their current house, Upwork’s study shows. But coming in a close second, 41.5 percent of people preparing to move as a result of working remotely would consider purchasing a home over four hours from their current location.

These numbers are depicted in the graph below:

This could be because, sometimes, moving farther away from your current area could allow you to get more for less, i.e., buying a larger or more updated home without increasing your housing budget. If you’re able to work from home, you might find many more homes just by broadening your search.

Of the remote workers polled, Upwork also says:

“People are seeking less expensive housing: Altogether, more than half (52.5 percent) are planning to move to a house that is significantly more affordable than their current home.”

Maybe you’d like to do away with your daily commute. Or, perhaps you just want more home office space. Either way, you might be changing your plans. If so, now is an ideal time to connect with a local loan officer to assess your new needs and discuss which low-cost loans are available.

More homebuyers than usual appear to be preparing to purchase, taking advantage of a uniquely affordable housing market at the end of 2020. Real estate is typically slow in the winter, but economists believe that’s unlikely this year. Low housing inventory and high buyer demand triggered by historically low rates are keeping the market booming.

Inventory might be an issue, depending on where you live. But again, there’s that silver lining.

Expanding your home search radius, as millions of remote workers are doing, can uncover hidden gems and give you more options. Once you find a home you love, it’s important to act quickly. Prequalifying for a mortgage now, even before you begin house-hunting, can give you a competitive advantage in a potential bidding war, making your offer more attractive.

Here’s a great reason to break up with your landlord

You can stop paying someone else’s mortgage, for starters. Not only that, you’ll be building your own investment. By paying your own mortgage each month, you’ll automatically begin to grow equity in your house. If your needs have changed because of working remotely, get in touch with a local loan officer and prequalify now.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.